Optimize Your Buying Power with a Jumbo Loan for High-End Houses

Optimize Your Buying Power with a Jumbo Loan for High-End Houses

Blog Article

Optimizing Your Home Buying Potential: An Extensive Appearance at Jumbo Car Loan Financing Options

Navigating the complexities of big car loan funding can considerably improve your home acquiring potential, especially for high-value residential or commercial properties that go beyond traditional funding restrictions. Understanding the qualification demands, including the requirement for a robust credit rating and substantial deposit, is crucial for prospective buyers (jumbo loan). Moreover, the affordable landscape of rate of interest and associated fees tests both provides and opportunities. As you take into consideration these factors, the concern stays: just how can you tactically placement on your own to take full advantage of these funding alternatives while reducing risks?

Recognizing Jumbo Fundings

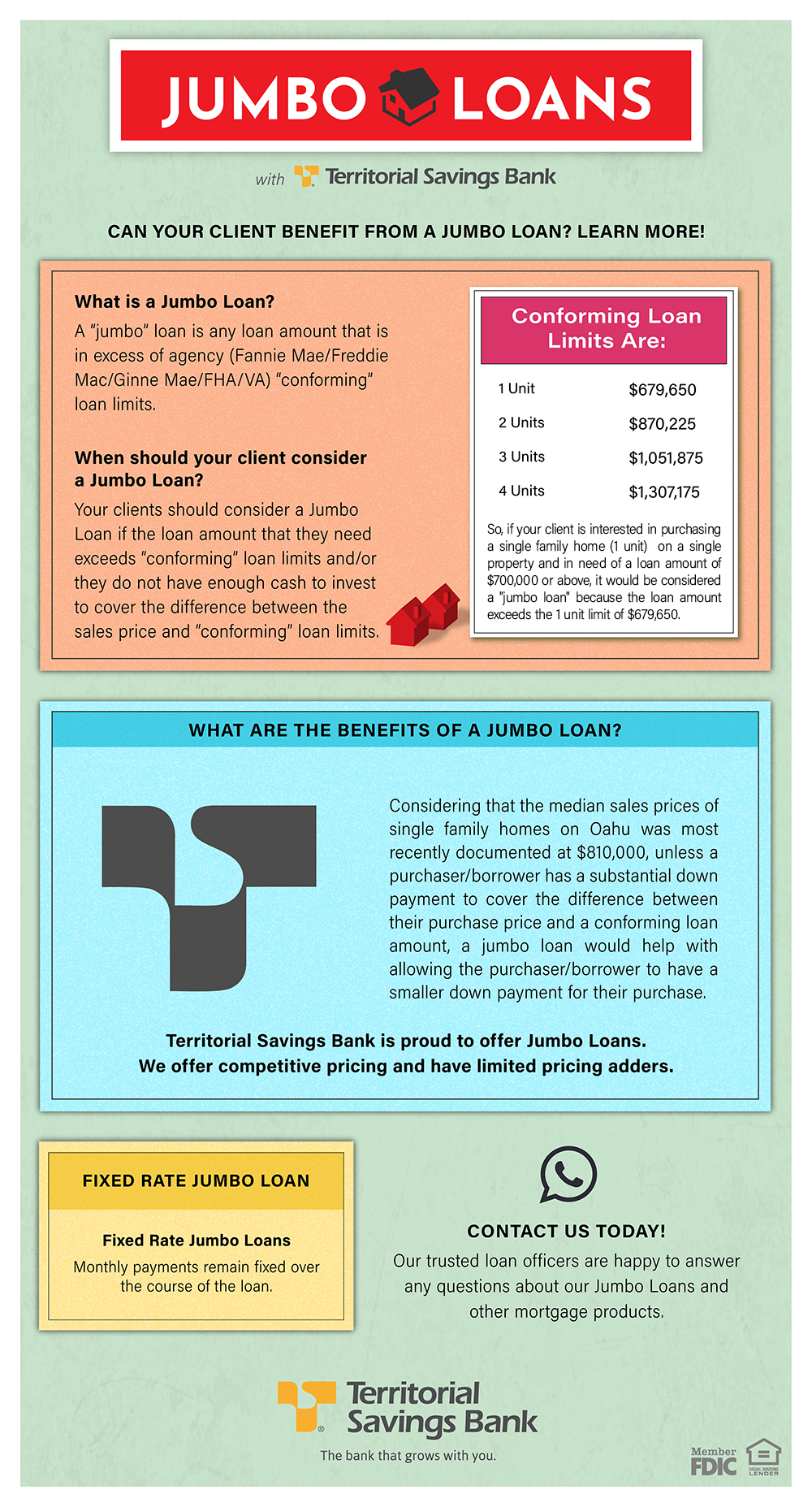

In the world of home loan financing, big car loans work as an essential alternative for consumers seeking to buy high-value residential properties that go beyond the adapting loan limitations established by government-sponsored enterprises. Typically, these restrictions differ by region and are established every year, often showing the regional housing market's characteristics. Jumbo financings are not backed by Fannie Mae or Freddie Mac, which identifies them from traditional fundings and presents various underwriting criteria.

These finances normally feature greater rate of interest due to the viewed threat connected with larger financing amounts. Consumers that choose big funding usually call for a much more considerable economic profile, including greater credit report and lower debt-to-income ratios. Additionally, jumbo finances can be structured as adjustable-rate or fixed-rate mortgages, enabling debtors to select a repayment plan that lines up with their financial objectives.

The significance of jumbo fundings prolongs past plain funding; they play a pivotal duty in the high-end actual estate market, making it possible for buyers to obtain properties that represent significant financial investments. As the landscape of mortgage options advances, recognizing big fundings comes to be important for browsing the intricacies of high-value building acquisitions.

Qualification Demands

To get approved for a jumbo financing, debtors need to satisfy specific qualification demands that vary from those of standard financing. Among the primary criteria is a greater credit report, usually calling for a minimum of 700. Lenders analyze creditworthiness rigorously, as the increased finance amounts require greater threat.

Furthermore, jumbo finance candidates typically need to give proof of significant revenue. Many loan providers prefer a debt-to-income ratio (DTI) of 43% or reduced, although some may permit as much as 50% under particular scenarios. This makes sure consumers can manage their monthly repayments without financial stress.

Moreover, significant properties or reserves are commonly called for. Lenders may ask for at the very least 6 months' worth of home mortgage payments in liquid assets, showing the consumer's ability to cover expenditures in situation of income disturbance.

Lastly, a bigger deposit is normal for big car loans, with lots of lenders expecting at the very least 20% of the purchase cost. This demand minimizes threat for lending institutions and shows the customer's commitment to the financial investment. Fulfilling these strict qualification standards is essential for securing a big loan and efficiently browsing the high-end property market.

Rate Of Interest Rates and Charges

Recognizing the ins and outs of rate of interest and costs related to jumbo financings is vital for possible debtors. Unlike adapting lendings, jumbo financings, which go beyond the conforming loan restrictions set by Fannie Mae and Freddie Mac, commonly come with higher rate of interest. This rise is attributable to the viewed danger lending institutions take on in funding these bigger financings, as they are not backed by government-sponsored business.

Rate of interest prices can differ considerably based on several variables, consisting of the consumer's credit scores rating, the loan-to-value proportion, and market conditions. It is important for consumers to search, as different lending institutions may supply differing rates and terms. Additionally, jumbo finances might involve greater costs, such as source charges, assessment fees, and private mortgage insurance coverage (PMI) if the down settlement is less than 20%.

To lessen prices, borrowers ought to meticulously examine the charge frameworks of different lending institutions, as some may use lower rates of interest but higher charges, while others may give a more balanced technique. Eventually, understanding these components assists consumers make educated decisions and enhance their funding choices when acquiring deluxe homes.

Advantages of Jumbo Lendings

Jumbo loans supply significant benefits for customers seeking to acquire high-value homes. One of the main advantages is that they give accessibility to funding that exceeds the adhering finance restrictions set by the Federal Real Estate Financing Firm (FHFA) This permits buyers to safeguard bigger financing amounts, making it possible to obtain extravagant homes or residential properties in extremely desired places.

Additionally, jumbo car loans typically come with affordable rate click over here of interest, specifically for customers with solid credit history profiles. This can result in substantial financial savings over the life of the funding. Additionally, big financings commonly permit for a range of financing terms and frameworks, providing versatility to customize the financing to fit individual financial scenarios and lasting goals.

One more key advantage is the capacity for lower deposit requirements, relying on the lender and consumer certifications. This allows buyers to go into the high-end realty market without requiring to devote a significant ahead of time resources.

Last but not least, big lendings can provide the opportunity for higher cash-out refinances, which can be valuable for home owners aiming to take advantage of their equity for various other investments or significant costs - jumbo loan. Overall, jumbo fundings can be a reliable device for those browsing the upper echelons of the real estate market

Tips for Getting Funding

Protecting financing for a big car loan needs careful prep work and a critical technique, particularly given the distinct attributes of these high-value mortgages. Begin by evaluating your financial health; a durable credit scores score, typically over 700, is crucial. Lenders view this as a sign of dependability, which is important for big fundings that go beyond adhering financing limitations.

Engaging with a mortgage broker experienced in big loans can supply important understandings and accessibility to a wider range of borrowing alternatives. By complying with these ideas, you can improve your chances of successfully safeguarding financing for your jumbo funding.

Conclusion

Finally, big financings use special benefits for customers seeking high-value residential or commercial properties, given they satisfy specific qualification requirements. With requirements such as a solid credit rating, low debt-to-income ratio, and significant deposits, prospective house owners can access high-end genuine estate possibilities. By comparing rates of interest and teaming up with skilled home mortgage brokers, individuals can enhance their home acquiring possible and make informed financial choices in the competitive property market.

Navigating the complexities of big loan funding can considerably enhance your home getting potential, especially for high-value properties that exceed traditional car loan limits.In the world of home mortgage funding, jumbo financings offer as an essential option for customers looking for to acquire high-value buildings that surpass the adjusting loan limitations established by government-sponsored enterprises. Unlike adhering lendings, big car loans, which go beyond the adapting car loan limitations set by Fannie Mae and Freddie Mac, normally come with higher passion rates. Big lendings commonly allow for a range of loan terms and look at more info structures, supplying flexibility to customize the financing to fit specific economic scenarios and long-lasting objectives.

Lenders view this click to find out more as an indication of dependability, which is important for big lendings that surpass adapting funding restrictions. (jumbo loan)

Report this page